UK Car Insurance – Overview and Advantages

Car insurance in the UK is not just a legal requirement—it’s a critical financial safeguard that offers peace of mind and protection in a wide range of driving scenarios. Whether you’re a new driver, a seasoned motorist, or someone simply looking to renew or switch providers, understanding the importance and benefits of car insurance in the UK is essential.

What is Car Insurance in the UK?

Car insurance is a contract between a vehicle owner and an insurance company that provides financial coverage against losses or damages caused by accidents, theft, or other unforeseen events. In the UK, it’s a legal requirement to have at least Third Party insurance to drive on public roads, with higher levels of coverage offering broader protection.

Types of Car Insurance in the UK

- Third Party Only (TPO)

- Minimum legal requirement.

- Covers damage to other people’s vehicles or property and injury to others, but not to your own vehicle.

- Third Party, Fire and Theft (TPFT)

- Offers safeguards against theft or fire-related damage to your automobile.

- Comprehensive

- Offers the most complete coverage, including damage to your own vehicle, even if you’re at fault.

Key Benefits of Car Insurance

- Legal Compliance

Having at least Third Party insurance ensures you comply with UK law. Driving without insurance can result in fines, points on your license, and even disqualification.

- Financial Protection

Accidents can lead to high costs for repairs, medical bills, or legal claims. Car insurance helps cover these expenses, reducing financial strain.

- Theft and Vandalism Coverage

TPFT and Comprehensive policies protect your vehicle against theft or malicious damage, which is especially valuable in urban or high-crime areas.

- Fire Damage Protection

Covered under TPFT and Comprehensive plans, fire protection ensures you’re not left with a total loss if your vehicle is damaged or destroyed by fire.

- Accident and Damage Coverage

Comprehensive insurance protects your vehicle from accidental damage, even when you’re at fault, giving you full control over repairs and replacements.

- Personal Injury Cover

Many policies offer personal accident cover for injuries sustained by you or your passengers, ensuring financial support during recovery.

- Courtesy Car

Comprehensive plans often include a courtesy car while your vehicle is being repaired, helping you stay mobile.

- Windscreen Repair

Some policies offer free or low-cost windscreen repairs and replacements, avoiding hefty repair bills for minor incidents.

- Breakdown Assistance

Add-ons like breakdown cover ensure you’re not stranded on the road, with services ranging from roadside repairs to vehicle recovery.

- No-Claims Discount (NCD)

Safe drivers are rewarded with discounts on their premiums for each year without a claim—some insurers offer up to 70% off after multiple claim-free years.

Choosing the Right Car Insurance

When comparing car insurance, consider:

- Your budget – balance cost vs. coverage.

- Your car’s value – expensive vehicles often require comprehensive protection.

- Your driving habits – mileage, location, and usage can affect premiums.

- Optional extras – such as legal protection, personal belongings cover, or key replacement.

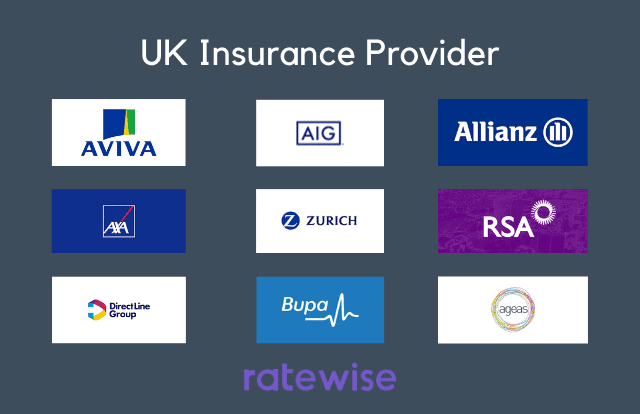

Use price comparison sites like Compare the Market, GoCompare, or MoneySuperMarket to find competitive quotes and policy features.

Final Thoughts

In the UK, car insurance is not merely a legal requirement; it is an essential aspect of responsible vehicle ownership.

Whether you opt for basic Third Party cover or a fully Comprehensive policy, the right insurance plan protects your vehicle, your finances, and your peace of mind.