Restaurant Insurance Coverage for Food Businesses

Running a food business comes with a unique set of risks, from kitchen fires to food borne illnesses and customer injuries. Whether you’re operating a fine-dining restaurant, a food truck, a cafe, or a catering business, restaurant insurance is essential to protect your investment and ensure long-term success. This article outlines the key types of restaurant insurance coverage and explains the benefits of having comprehensive protection.

Why Restaurant Insurance is Crucial

Restaurants face daily challenges that could result in significant financial losses or even business closure. Accidents, employee injuries, property damage, and lawsuits are just a few examples. Restaurant insurance helps food business owners:

- Safeguard assets and property

- Mitigate liability risks

- Ensure business continuity

- Comply with legal and regulatory requirements

- Gain peace of mind

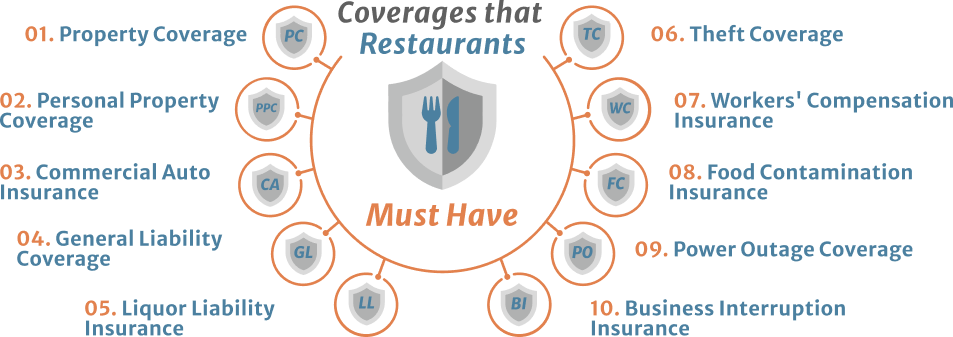

Key Types of Restaurant Insurance Coverage

- General Liability Insurance

This foundational coverage protects your business from claims involving bodily injury, property damage, and advertising injury. For instance, if a customer slips and falls on a wet floor, general liability insurance can cover medical expenses and legal fees.

Benefits:

- Covers customer injuries on premises

- Protects against property damage claims

- Handles legal defense costs

- Commercial Property Insurance

This policy covers your building (if owned) and contents like furniture, kitchen equipment, inventory, and signage in the event of fire, theft, vandalism, or natural disasters.

Benefits:

- Repairs or replaces damaged equipment

- Covers building damage

- Helps recover quickly from disasters

- Business Interruption Insurance

Also known as business income insurance, this provides coverage for lost income if your restaurant has to shut down temporarily due to a covered event, such as a fire or flood.

Benefits:

- Replaces lost income during downtime

- Covers ongoing expenses (rent, payroll, utilities)

- Helps maintain cash flow during recovery

- Workers’ Compensation Insurance

Mandatory in most states, this coverage provides medical benefits and wage replacement to employees injured on the job. It further shields the organisation from lawsuits associated with injuries occurring in the workplace.

Benefits:

- Covers employee medical expenses

- Pays for rehabilitation and lost wages

- Reduces risk of legal disputes

- Liquor Liability Insurance

It is imperative to have this policy in place for establishments that serve alcohol. It protects against claims arising from alcohol-related incidents, such as intoxicated patrons causing harm to others or property.

Benefits:

- Shields against alcohol-related lawsuits

- Required by many states and municipalities

- Safeguards your liquor license

- Product Liability Insurance

This protects your restaurant from claims of illness or injury caused by the food or beverages served.

Benefits:

- Covers food poisoning and allergen-related claims

- Helps maintain brand reputation

- Reduces financial impact of lawsuits

- Commercial Auto Insurance

For food trucks, delivery services, or catering vans, commercial auto insurance covers damages and liability related to vehicle accidents.

Benefits:

- Covers vehicle repairs and medical costs

- Offers liability protection for road accidents

- Complies with legal vehicle insurance requirements

- Cyber Liability Insurance

Restaurants increasingly rely on digital point-of-sale (POS) systems and online ordering, making them vulnerable to data breaches and cyber attacks.

Benefits:

- Covers data breach response costs

- Protects against loss of customer data

- Helps with legal compliance and notification expenses

Tailoring Your Insurance Policy

Every restaurant has different needs depending on its size, location, and services offered. A small coffee shop may not require the same coverage as a large full-service restaurant or mobile food truck. Working with an experienced insurance broker can help you customize a policy that fits your specific business risks and budget.

Conclusion

Restaurant insurance is more than a safety net—it’s a strategic investment that protects your business, employees, and customers. By understanding the various types of coverage available, food business owners can create a comprehensive insurance plan that supports long-term stability and success. Whether you’re just starting out or expanding operations, ensuring the right protection is in place is a critical step toward culinary and financial peace of mind.